All the cryptocurrencies

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales empire slot. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

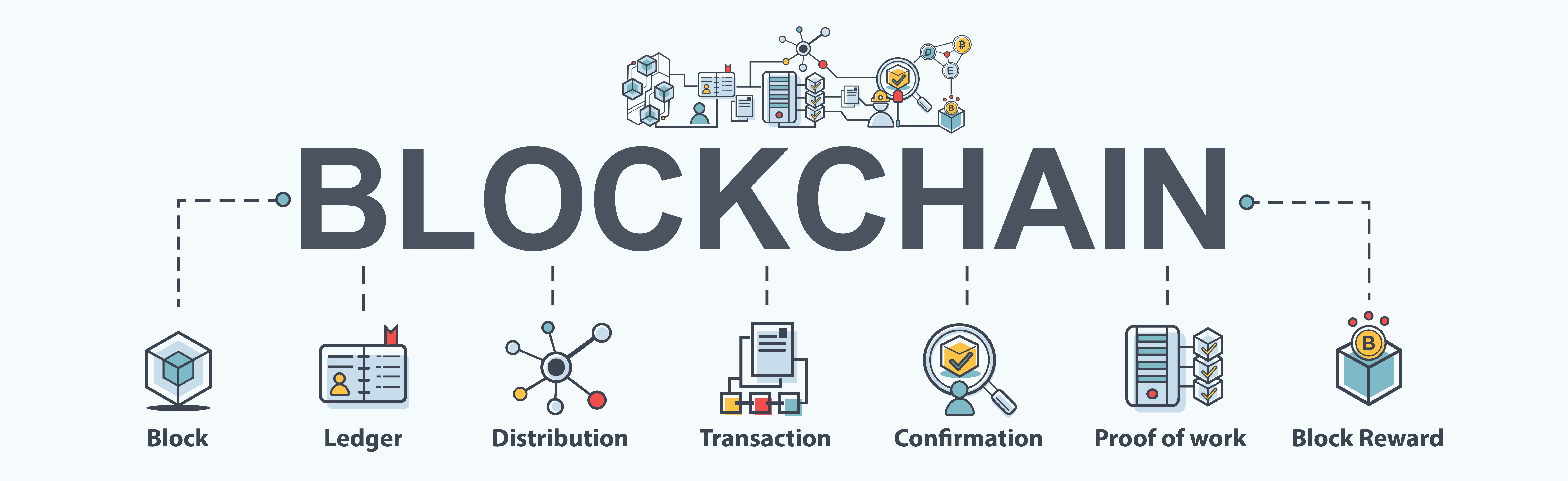

A blockchain is a type of distributed ledger that is useful for recording the transactions and balances of different participants. All transactions are stored in blocks, which are generated periodically and linked together with cryptographic methods. Once a block is added to the blockchain, data contained within it cannot be changed, unless all subsequent blocks are changed as well.

Bitcoin is the most popular cryptocurrency and enjoys the most adoption among both individuals and businesses. However, there are many different cryptocurrencies that all have their own advantages or disadvantages.

One of the biggest winners is Axie Infinity — a Pokémon-inspired game where players collect Axies (NFTs of digital pets), breed and battle them against other players to earn Smooth Love Potion (SLP) — the in-game reward token. This game was extremely popular in developing countries like The Philippines, due to the level of income they could earn. Players in the Philippines can check the price of SLP to PHP today directly on CoinMarketCap.

However, not all cryptocurrencies work in the same way. While all cryptocurrencies leverage cryptographic methods to some extent (hence the name), we can now find a number of different cryptocurrency designs that all have their own strengths and weaknesses.

Are all cryptocurrencies based on blockchain

Because of the decentralized nature of the Bitcoin blockchain, all transactions can be transparently viewed by downloading and inspecting them or by using blockchain explorers that allow anyone to see transactions occurring live. Each node has its own copy of the chain that gets updated as fresh blocks are confirmed and added. This means that if you wanted to, you could track a bitcoin wherever it goes.

How do I purchase Bitcoins? This will depend on your chosen exchange, but you will generally need to provide some form of ID and proof of residence as well as bank account information. Some exchanges may make you verify your identity before purchasing while others will require only identification.

You might be familiar with spreadsheets or databases. A blockchain is somewhat similar because it is a database where information is entered and stored. The key difference between a traditional database or spreadsheet and a blockchain is how the data is structured and accessed.

Because of the decentralized nature of the Bitcoin blockchain, all transactions can be transparently viewed by downloading and inspecting them or by using blockchain explorers that allow anyone to see transactions occurring live. Each node has its own copy of the chain that gets updated as fresh blocks are confirmed and added. This means that if you wanted to, you could track a bitcoin wherever it goes.

How do I purchase Bitcoins? This will depend on your chosen exchange, but you will generally need to provide some form of ID and proof of residence as well as bank account information. Some exchanges may make you verify your identity before purchasing while others will require only identification.

All the cryptocurrencies

On the other hand, tokens are digital assets that are not native to a particular blockchain but are created on existing blockchain platforms, typically through tokenization. Tokens can represent various types of assets, such as utility tokens, security tokens, or non-fungible tokens (NFTs). They can be easily created using templates, where developers specify parameters like initial supply, number of decimals, and other metadata. Most tokens are created on established blockchain networks like Ethereum, using standards such as ERC-20 for fungible tokens and ERC-721 for non-fungible tokens.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

A stablecoin is a cryptocurrency designed to maintain a stable value, often by pegging it to a fiat currency like the US dollar. This stability helps reduce the price volatility typically associated with cryptocurrencies such as Bitcoin and Ethereum. Stablecoins enable transactions on blockchain networks while minimizing fluctuations in value, which can be particularly useful during market turbulence. Tether’s USDT was the first stablecoin introduced and remains one of the most popular options in the market today. Other examples are USDC and BUSD.

On the other hand, tokens are digital assets that are not native to a particular blockchain but are created on existing blockchain platforms, typically through tokenization. Tokens can represent various types of assets, such as utility tokens, security tokens, or non-fungible tokens (NFTs). They can be easily created using templates, where developers specify parameters like initial supply, number of decimals, and other metadata. Most tokens are created on established blockchain networks like Ethereum, using standards such as ERC-20 for fungible tokens and ERC-721 for non-fungible tokens.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

A stablecoin is a cryptocurrency designed to maintain a stable value, often by pegging it to a fiat currency like the US dollar. This stability helps reduce the price volatility typically associated with cryptocurrencies such as Bitcoin and Ethereum. Stablecoins enable transactions on blockchain networks while minimizing fluctuations in value, which can be particularly useful during market turbulence. Tether’s USDT was the first stablecoin introduced and remains one of the most popular options in the market today. Other examples are USDC and BUSD.